來源:中國網(wǎng)地產(chǎn) 時間:2020-07-27 08:18:10

7月24日晚間,貝殼找房正式在美國提交招股書,股票代碼為BEKE。

以下內(nèi)容為中國網(wǎng)地產(chǎn)依據(jù)招股書內(nèi)容翻譯,內(nèi)容或有出入。

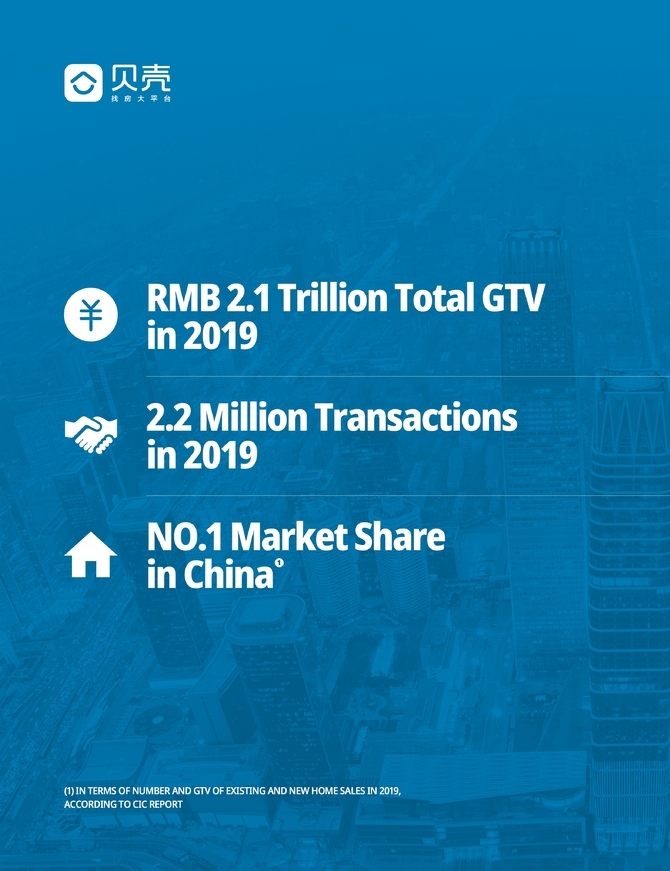

The total GTV on our platform was RMB999.2 billion for the three months ended June 30, 2020, including RMB583.5 billion from existing home transactions, RMB376.6 billion from new home transactions, and RMB39.1 billion from emerging and other services, as compared to RMB529.8 billion of total GTV, consisting of RMB345.2 billion, RMB165.2 billion, and RMB19.4 billion from existing home transactions, new home transactions, and emerging and other services, respectively, for the same period of 2019. In addition, there were over 42,000 stores and 456,000 agents on our platform as of June 30, 2020, as compared to over 24,000 stores and 250,000 agents as of June 30, 2019.

截至2020年6月30日的三個月,平臺上的GTV總額為人民幣9,993億元,其中,既有房屋交易為人民幣5,835億元,新房交易為人民幣3,766億元,新興服務(wù)及其他服務(wù)為人民幣391億元GTV總額為人民幣5,298億元,分別由同期的現(xiàn)有房屋交易,新房屋交易以及新興及其他服務(wù)的人民幣3,452億元,人民幣1,652億元和人民幣194億元組成截至2019年。此外,截至2020年6月30日,我們的平臺上有超過42,000家商店和456,000名代理商,而截至2019年6月30日,則有超過24,000家商店和250,000名代理商。

We estimate that our revenue in the three months ended June 30, 2020 was no less than RMB19.7 billion, representing an increase of approximately 72.4% from RMB11.5 billion in the same period of 2019, primarily as a result of an approximately 35.8% increase in the revenue from our existing home transaction service business and an approximately 128.6% increase in the revenue from our new home transaction service business.

我們估計截至2020年6月30日止三個月的收入不少于人民幣197億元,較2019年同期的人民幣115億元增加約72.4%,主要是由于約35.8現(xiàn)有住房交易服務(wù)業(yè)務(wù)的收入增長%,而新住房交易服務(wù)業(yè)務(wù)的收入增長約128.6%。

We estimate that our net income in the three months ended June 30, 2020 was no less than RMB2.7 billion, representing a 589.3% increase from RMB0.4 billion in the same period of 2019, primarily as a result of the surge of demand for housing transactions after the economy reopening in the second quarter of 2020 and the improvement of operating leverage as our platform further scaled. Excluding the impact of share-based compensation expenses, amortization of intangible assets resulting from acquisition and business cooperation agreement, changes in fair value from long term investments, loan receivables measured at fair value and contingent consideration, and their tax effects, our adjusted net income is estimated to be no less than RMB2.8 billion in the three months ended June 30, 2020, as compared to RMB0.9 billion in the same period of 2019.

我們估計,截至2020年6月30日的三個月,我們的凈收入不少于27億元人民幣,較2019年同期的4億元人民幣增長589.3%,主要是由于需求激增 在2020年第二季度經(jīng)濟重新開放以及隨著我們的平臺進一步擴展而提高的經(jīng)營杠桿率之后,房屋交易將變得越來越重要。 不包括股權(quán)激勵費用,收購和業(yè)務(wù)合作協(xié)議產(chǎn)生的無形資產(chǎn)攤銷,長期投資的公允價值變動,以公允價值和或有對價計量的應(yīng)收貸款及其稅收影響,調(diào)整后的凈收益的影響 截至2020年6月30日止三個月,估計不少于28億元人民幣,而2019年同期為9億元人民幣。

-

年夜飯幾個菜最吉利?年夜飯什么時候吃?

年夜飯幾個菜最吉利?年夜飯一般做6個菜或8個菜比較吉利,6有六六大順的之意,而8有發(fā)的意思...

-

中水是什么水?中水和自來水的區(qū)別

中水是什么水?中水是再生水。廢水或雨水經(jīng)適當處理后達到一定的水質(zhì)指標,滿足某種使用要...

-

山西省區(qū)號是多少?區(qū)號是怎么劃分的?

山西省區(qū)號是多少?山西省電話區(qū)號是0349-0359。其中11個地級市的區(qū)號分別是:朔州區(qū)號0349...

-

孫悟空第一個師傅是誰?孫悟空的性格特點

孫悟空的第一個師傅是誰?孫悟空的第一個師傅是菩提祖師。孫悟空原本是一只普通猴子,向菩...

- 選對番茄醬=拿捏住了意式披薩的靈魂

- 武漢理工大學(xué)卜童樂研究員在鈣鈦礦電池模組制備技術(shù)上取得新進展

- 北白犀還有救嗎?只剩最后兩頭,都是母的,護衛(wèi)24小時帶槍保護

- 實驗猴一只16萬元,藥企瘋狂“囤猴”!發(fā)生了什么?

- 33億光年外,中國天眼重大發(fā)現(xiàn),或?qū)⑵平庥钪娴囊粋€謎題

- 中科院取得多模態(tài)神經(jīng)感知研究進展,有助研發(fā)高智能機器人

- 風(fēng)電機成新頂級食肉動物,絞殺1300只猛禽,還有必要發(fā)展風(fēng)電嗎?

- 日本理化所利用量子化學(xué)機器學(xué)習(xí),熒光分子合成成功率75%

- 3年、5年、7年以上的老巖茶,適合新手嗎?巖茶怎么入門比較好?

- 發(fā)現(xiàn)“天馬”!拍到多只“麒麟獸”中華鬣羚,體高腿長有獸角

- 中國天眼每天要花40萬,位于貴州山區(qū)的它,目前都發(fā)現(xiàn)了什么

- 峨眉山“人猴大戰(zhàn)”頻發(fā),從靈猴淪為“街溜子”,到底是誰的錯?

- 排隊四小時的新式茶飲,需要新故事

- 江西人點的宴客菜,看完終于明白:為啥江西人被叫“辣不怕”了

- 可再生能源新寵兒?華人科學(xué)家“變廢為寶”,或?qū)⒔鉀Q百年難題

- “昨天喝多了把這個扛回家了,現(xiàn)在醒酒了我該怎么辦?”哈哈哈

- 江西各地級市的“市樹、市花”,你都知道嗎?

- 西雙版納發(fā)現(xiàn)“森林精靈”,長得像老鼠又像小鹿,比大熊貓稀有

- 長頸鹿脖子為何那么長?為了吃嗎?科學(xué)家:有利于找對象

- 宇宙深空一直發(fā)射著神秘信號,每16天出現(xiàn)一次,是誰發(fā)出的?

- 芒種前后,這5種美食別錯過,應(yīng)季而食營養(yǎng)高,早吃早受益

- 方太:有一種勇氣叫“從零到一”

- 高考倒計時,做幾款童趣早餐,給孩子解解壓!營養(yǎng)簡單娃喜歡!

- 長點兒心吧!別花冤枉錢了,你以為喝著正品紅牛,其實是侵權(quán)的

- “玉兔精”李玲玉教人做菜,用名貴紅酒煮一顆梨,被質(zhì)疑太奢侈

- “時間”是否存在,一名女性在洞穴中住130天,科學(xué)家得出結(jié)論

- 醫(yī)藥生物行業(yè)專題報告:mRNA技術(shù)有望迎來黃金十年

- 我國口服抗癌疫苗基礎(chǔ)研究取得新進展

- 炒肉時,牢記4個技巧,不管炒什么肉都鮮嫩多汁,不腥不柴還入味

- 美國科學(xué)家:土衛(wèi)六和地球相似度極高,但它太奇怪了

- 外星人為何沒造訪地球?美科學(xué)家:外星文明太發(fā)達陷危機,不來了

- “每天二兩醋,不用去藥鋪”?沒事吃點醋,身體或收獲這些好處

- 老虎的吼叫,能麻痹動物,它會在捕獵過程中當“定身術(shù)”用嗎?

- 重磅!湯加火山爆發(fā)為百年來最猛烈,對全球氣候的影響值得再研究

- 3根排骨1包醬,這一個做法廣東人百吃不膩,每一次做吃完還舔舔手

- 蚊子最大的天敵,竟然不是蚊香?別不相信!只需5分鐘蚊子消失了

- 月球上豎立五星紅旗,美國登月再被質(zhì)疑,美國國旗為何在飄動?

- 對標傳統(tǒng)儲存方案,一克可儲存2.15億GB數(shù)據(jù)!DNA儲存時代到來?

- 南方人的寶貝,北方人聽名字就嚇一跳!香甜軟糯一口淪陷!

- 4款“奶奶輩”的傳統(tǒng)糕點,都是兒時記憶中的味道,看看你吃過嗎

- 狗子被主人“養(yǎng)熟”,一般有這7個信號,別后知后覺

- 不明原因兒童急性肝炎與新冠有關(guān)?柳葉刀子刊最新研究激起千層浪

- 蚊子最大的天敵,竟然不是蚊香?別不信,只需5分鐘蚊子“不見了”

- 新冠病毒在野生動物中傳播,意味著什么?會傳染給人類嗎?

- “注膠肉”已泛濫,大多存在這3種肉當中,別再買錯

- 哪些女性適合剖腹產(chǎn)?寶寶的第一口應(yīng)該吃什么?

- 人類是茫茫宇宙唯一的智慧文明嗎?不然會什么會一直找不到外星人

- 26000萬光年外,質(zhì)量是太陽的400萬倍,巨大黑洞會吞噬地球嗎

- 東莞理工學(xué)院科研團隊提出短期電力負荷預(yù)測的新方法

- 沒想到四川人這么愛吃甜,看過四川的“8大甜食”,真甜到心里

- 中科院院士相信外星人存在?53年前的一塊小隕石,能證明他的觀點

- 螺螄怎么做才好吃?大廚教你正確做法,麻辣鮮香,解饞過癮

- 小看了日本?日科學(xué)家搞定海水淡化實驗,全球幾十億人有福了

- 1.6米長的“吃人鱷”現(xiàn)身蘇州,重15公斤,人為放生的概率最大?

- 鵪鶉蛋放鍋里一蒸,想不到這么好吃,好多人不知道的做法,真香

- 原來水不是只有固態(tài)、液態(tài)和氣態(tài),“第四種水”在深海中被發(fā)現(xiàn)

- 黑猩猩奧利弗:個別染色體發(fā)生突變,與人類基因相似性只差1.2%

- 沖泡白茶餅的5個步驟,簡單好學(xué)又能喝到好茶,行家天天都在用

- 廈門這家私房潮州菜人均600+,鮑參翅肚十余種做法,還可飲茶撫琴

- 最近迷上這早餐,一次蒸2大鍋,口味多多不重樣,天天都能睡懶覺

- 喜歡吃藍莓,自己在家養(yǎng),一棵能摘一大筐,好吃又營養(yǎng)

- 喵星人與汪星人,祖先是野生動物,一本繪本讀懂家養(yǎng)動物馴化史

- 抱著愛犬睡了一整晚,一早醒來卻發(fā)現(xiàn)這是一只陌生汪!

- 火星上發(fā)現(xiàn)“石門”?看起來像人造結(jié)構(gòu),NASA:好奇號火星車拍攝

- 在睡夢中到達木衛(wèi)四!未來的星際旅行會在冬眠中進行嗎?

- 饅頭不蓬松?試試加點它!細膩柔軟香味濃,比白面饅頭滋潤!

- 建議大家,若不差錢,多囤這5款“純糧好酒”,家里長輩都愛喝

- 石榴貴族——突尼斯石榴,價格比普通石榴貴多了,我們要怎么種?

- 榴蓮如何挑選?別只會挑圓的,牢記3個小技巧,挑榴蓮不發(fā)愁了

- 自己做面包,一滴水不用放特簡單,暄軟好吃鈣質(zhì)高,比買的好多了

- 它是“天然抗菌劑”殺菌防感冒,這季節(jié)別錯過,多買些儲存慢慢吃

- 罕見!浙江九龍山拍到黃喉貂,個頭不大卻是野豬天敵,行蹤很神秘

- 蚊子最怕的東西,竟然不是蚊香?你別不信,只需5分鐘蚊子消失了

- 80年代很火的“白皮黃瓜”,為啥后來遭淘汰了?答案讓人意外

- 廣州市白云區(qū)有一家“網(wǎng)紅”餐廳,招牌是螺螄粉,幾乎天天都排隊

- 土衛(wèi)六天然氣是地球的數(shù)百倍,儲量豐富,如果不小心點燃會怎樣?

- 自從學(xué)會了這小點心,孩子三天兩頭點名要吃,香甜酥脆,好吃極了

- 涼拌干豆腐時,萬萬不可切完直接拌,教你正確做法,太好吃了

- 金駿眉、大紅袍、茉莉花茶、綠茶,200克僅99.8元,是撿大漏嗎?

- 隔夜肉、隔夜菜、隔夜水、隔夜蛋,哪種不能吃?現(xiàn)在知道也不算晚

- 粉紅鴿:經(jīng)歷了渡渡鳥同樣的命運,一度剩十余只,結(jié)局卻大不同

- 號稱抑制新冠病毒能力靠前的千金藤素,療效是否被夸大?

- 無需進化,便在氣候多變的地球上活了5億年,海蜘蛛怎么做到的?

- 經(jīng)典農(nóng)家菜酸菜燒雞中多加一種時令菜,味道更鮮,外面很難吃到

- 連骨頭都能一起吃的酥骨鯽魚,骨酥肉爛,不擔(dān)心卡刺,下飯又解饞

- 千金藤素強效抗新冠,會成為第二個青蒿素嗎?我們還有這些路要走

- 此花人稱“賽牡丹”,花色艷麗,香味濃,抗旱耐寒,現(xiàn)在正值花期

- 曬曬北京四口人的晚餐,葷素搭配美味下飯,好吃好做,家人都愛吃

- 蚊子的“克星”竟不是蚊香?難怪總被咬!試試這招,蚊子繞道走!

- 火星地下真有外星生物?NASA“好奇號”發(fā)現(xiàn)一道小門,看起來奇怪

- 在流星雨下許愿?別急,先來看看我們的距離

- 小滿前后,多給孩子吃這個東西,開胃促消化,提高身體免疫力!

- 讓人驚奇,我們的飛船是外星人的文物,這是真的嗎?

- 中國原創(chuàng)阿爾茨海默病藥的國際臨床試驗暫停,綠谷解釋兩大原因

- 同樣是絲瓜,選有棱的還是無棱的好?老菜農(nóng):選錯難吃,還費錢

- 2塊錢就能搞定的菜,麻辣香菇腳,鮮香解饞真開胃,好吃還下飯

- 成都菜市場的“回鍋雞”,老板賣了14年,街坊四鄰拿盆端,味道好

- 獵境生物獲百萬級政府支持和百萬投資,用植物合成重組蛋白及疫苗

- 3米長、14斤眼鏡蛇被卡在車里!人能與蛇共處?還真有罕見個例子

- 香菇鮮肉包,鮮美多汁,簡單又好吃,白胖又軟乎

“少年航天科普特訓(xùn)營”舉行,VR空間站引關(guān)注

- 體育賽事行業(yè)規(guī)模持續(xù)增長 電子競技類專業(yè)引人注目

- 國內(nèi)游戲版號停發(fā)超半年 游戲出海成行業(yè)發(fā)展重點

- 電競行業(yè)壓力大,看電競選手的苦與樂

- 我國建立首個游戲音頻設(shè)計與開發(fā)流程團體標準

- 游戲裝備可被繼承 虛擬財產(chǎn)不“虛無”

- 國風(fēng)游戲為中國電影“出海”開辟新路徑

- 電競有無限的機會和可能

- 手游行業(yè)迅速發(fā)展 游戲?qū)κ謾C性能的需求不斷飆升

- 原汁原味懷舊版 點燃青春記憶

- 玩游戲成新一代社交方式

- “宅經(jīng)濟”風(fēng)口 助推中國游戲“出海”新路徑

- 提高安全警惕 謹防手游網(wǎng)游詐騙

- 中國互聯(lián)網(wǎng)大會在線互動體驗展

- “玩”出出息 “玩”出將來

- 天天象棋殘局挑戰(zhàn)190期詳細攻略

- 手游《慶余年》“逢君測試”已經(jīng)落下帷幕

- 《尋道大千》守衛(wèi)修真世界和平 齊心協(xié)力面對威脅

- 《尋道大千》 東方修真角色養(yǎng)成手機游戲

- Epic不滿蘋果商店30%分成發(fā)短片諷刺

- Pearl Abyss2020年第二季度創(chuàng)造38%的營業(yè)利潤率